Douglas County Nevada Real Estate Taxes . (university of nevada) county manager; Information on redevelopment area #2. the median property tax in douglas county, nevada is $1,745 per year for a home worth the median value of $375,800. the douglas county treasurer's office oversees the billing, collection, and apportionment of taxes on all real properties. Tax cap — frequently asked questions. We pride ourselves in providing. visit our online payment center for methods in which to pay your property tax, as well as associated fees if applicable. *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. to compute the property taxes for a parcel of property the assessed valuation is multiplied by the tax rate. Search for information about assessed values and sales of properties in douglas county.

from www.recordcourier.com

the median property tax in douglas county, nevada is $1,745 per year for a home worth the median value of $375,800. (university of nevada) county manager; Tax cap — frequently asked questions. to compute the property taxes for a parcel of property the assessed valuation is multiplied by the tax rate. visit our online payment center for methods in which to pay your property tax, as well as associated fees if applicable. *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. We pride ourselves in providing. Information on redevelopment area #2. Search for information about assessed values and sales of properties in douglas county. the douglas county treasurer's office oversees the billing, collection, and apportionment of taxes on all real properties.

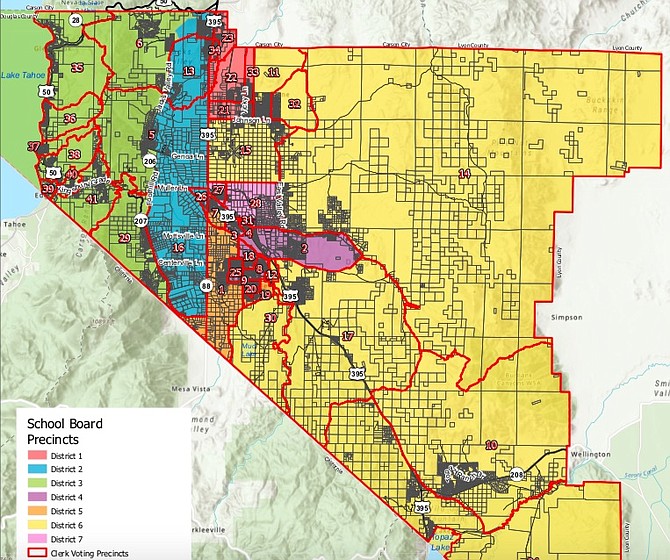

County posts new election district maps Serving MindenGardnerville

Douglas County Nevada Real Estate Taxes Information on redevelopment area #2. Tax cap — frequently asked questions. Search for information about assessed values and sales of properties in douglas county. *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. the douglas county treasurer's office oversees the billing, collection, and apportionment of taxes on all real properties. We pride ourselves in providing. (university of nevada) county manager; visit our online payment center for methods in which to pay your property tax, as well as associated fees if applicable. the median property tax in douglas county, nevada is $1,745 per year for a home worth the median value of $375,800. to compute the property taxes for a parcel of property the assessed valuation is multiplied by the tax rate. Information on redevelopment area #2.

From uspopulation.org

Douglas County, Nevada Population Demographics, Employment Douglas County Nevada Real Estate Taxes Information on redevelopment area #2. the median property tax in douglas county, nevada is $1,745 per year for a home worth the median value of $375,800. We pride ourselves in providing. Search for information about assessed values and sales of properties in douglas county. (university of nevada) county manager; to compute the property taxes for a parcel of. Douglas County Nevada Real Estate Taxes.

From diaocthongthai.com

Map of Douglas County, Nevada Douglas County Nevada Real Estate Taxes to compute the property taxes for a parcel of property the assessed valuation is multiplied by the tax rate. (university of nevada) county manager; *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. the median property tax in douglas. Douglas County Nevada Real Estate Taxes.

From www.land.com

40 acres in Douglas County, Nevada Douglas County Nevada Real Estate Taxes Search for information about assessed values and sales of properties in douglas county. We pride ourselves in providing. the douglas county treasurer's office oversees the billing, collection, and apportionment of taxes on all real properties. *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person,. Douglas County Nevada Real Estate Taxes.

From www.land.com

5 acres in Douglas County, Nevada Douglas County Nevada Real Estate Taxes (university of nevada) county manager; Search for information about assessed values and sales of properties in douglas county. visit our online payment center for methods in which to pay your property tax, as well as associated fees if applicable. to compute the property taxes for a parcel of property the assessed valuation is multiplied by the tax rate.. Douglas County Nevada Real Estate Taxes.

From www.invaluable.com

Sold at Auction Large map of Douglas Co., Nevada, 1924 Douglas County Nevada Real Estate Taxes the douglas county treasurer's office oversees the billing, collection, and apportionment of taxes on all real properties. Information on redevelopment area #2. Search for information about assessed values and sales of properties in douglas county. (university of nevada) county manager; *tax payments made on the last (10th) day of the grace period for each installment period are accepted. Douglas County Nevada Real Estate Taxes.

From www.recordcourier.com

County posts new election district maps Serving MindenGardnerville Douglas County Nevada Real Estate Taxes to compute the property taxes for a parcel of property the assessed valuation is multiplied by the tax rate. the median property tax in douglas county, nevada is $1,745 per year for a home worth the median value of $375,800. (university of nevada) county manager; *tax payments made on the last (10th) day of the grace period. Douglas County Nevada Real Estate Taxes.

From www.financestrategists.com

Find the Top Financial Advisors Serving Douglas County, NV Douglas County Nevada Real Estate Taxes Information on redevelopment area #2. *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. the median property tax in douglas county, nevada is $1,745 per year for a home worth the median value of $375,800. the douglas county treasurer's. Douglas County Nevada Real Estate Taxes.

From www.land.com

5 acres in Douglas County, Nevada Douglas County Nevada Real Estate Taxes Information on redevelopment area #2. to compute the property taxes for a parcel of property the assessed valuation is multiplied by the tax rate. visit our online payment center for methods in which to pay your property tax, as well as associated fees if applicable. *tax payments made on the last (10th) day of the grace period. Douglas County Nevada Real Estate Taxes.

From www.recordcourier.com

Douglas County legal 46524 Serving MindenGardnerville and Carson Douglas County Nevada Real Estate Taxes *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. the median property tax in douglas county, nevada is $1,745 per year for a home worth the median value of $375,800. (university of nevada) county manager; Search for information about assessed. Douglas County Nevada Real Estate Taxes.

From www.vrogue.co

Douglas County Nv Wall Map Premium Style By Marketmaps Mapsales Vrogue Douglas County Nevada Real Estate Taxes *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. (university of nevada) county manager; Search for information about assessed values and sales of properties in douglas county. Tax cap — frequently asked questions. Information on redevelopment area #2. the median. Douglas County Nevada Real Estate Taxes.

From www.realtor.com

Douglas County, NV Real Estate & Homes for Sale Douglas County Nevada Real Estate Taxes *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. visit our online payment center for methods in which to pay your property tax, as well as associated fees if applicable. Search for information about assessed values and sales of properties. Douglas County Nevada Real Estate Taxes.

From douglas.lpnevada.org

Douglas County Libertarian Party Douglas County Nevada Real Estate Taxes Search for information about assessed values and sales of properties in douglas county. *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. Tax cap — frequently asked questions. visit our online payment center for methods in which to pay your. Douglas County Nevada Real Estate Taxes.

From legaltemplates.net

Nevada Quitclaim Deed Costs and Fees LegalTemplates Douglas County Nevada Real Estate Taxes Tax cap — frequently asked questions. the douglas county treasurer's office oversees the billing, collection, and apportionment of taxes on all real properties. *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. Information on redevelopment area #2. We pride ourselves. Douglas County Nevada Real Estate Taxes.

From www.land.com

0.34 acres in Douglas County, Nevada Douglas County Nevada Real Estate Taxes (university of nevada) county manager; We pride ourselves in providing. the median property tax in douglas county, nevada is $1,745 per year for a home worth the median value of $375,800. to compute the property taxes for a parcel of property the assessed valuation is multiplied by the tax rate. visit our online payment center for methods. Douglas County Nevada Real Estate Taxes.

From www.landsofamerica.com

2.2 acres in Douglas County, Nevada Douglas County Nevada Real Estate Taxes *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. (university of nevada) county manager; the median property tax in douglas county, nevada is $1,745 per year for a home worth the median value of $375,800. Search for information about assessed. Douglas County Nevada Real Estate Taxes.

From www.realtor.com

Douglas County, NV Real Estate & Homes for Sale Douglas County Nevada Real Estate Taxes (university of nevada) county manager; the douglas county treasurer's office oversees the billing, collection, and apportionment of taxes on all real properties. visit our online payment center for methods in which to pay your property tax, as well as associated fees if applicable. Search for information about assessed values and sales of properties in douglas county. Information on. Douglas County Nevada Real Estate Taxes.

From www.amazon.com

Working Maps Douglas County, Nevada NV Zip Code Map Not Douglas County Nevada Real Estate Taxes *tax payments made on the last (10th) day of the grace period for each installment period are accepted until 5 pm in person, until 5 pm on. Tax cap — frequently asked questions. visit our online payment center for methods in which to pay your property tax, as well as associated fees if applicable. to compute the. Douglas County Nevada Real Estate Taxes.

From www.land.com

1 acres in Douglas County, Nevada Douglas County Nevada Real Estate Taxes (university of nevada) county manager; We pride ourselves in providing. visit our online payment center for methods in which to pay your property tax, as well as associated fees if applicable. Information on redevelopment area #2. Search for information about assessed values and sales of properties in douglas county. the median property tax in douglas county, nevada is. Douglas County Nevada Real Estate Taxes.